For instance, enter “-10.59” instead of “(10.59).” However, if your software solely permits for parentheses in getting into unfavorable quantities, you could use them. Always ensure the EIN on the form you file precisely matches the EIN the IRS assigned to your business. Don’t use your SSN or ITIN on forms that ask for an EIN. If you used an EIN (including a previous owner’s EIN) on Kind 941 that is different from the EIN reported on Type W-3, see Box h—Other EIN used this year within the Basic Directions for Forms W-2 and W-3. On Form W-3 (PR), “Other EIN used this year” is reported in field f. Submitting a Kind 941 with an incorrect EIN or utilizing another enterprise’s EIN might end in penalties and delays in processing your return.

What Is Type 941? Information And Submitting Ideas For Small Businesses

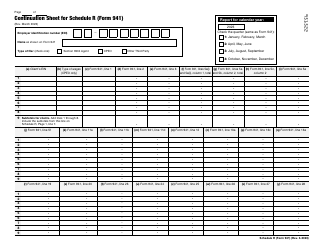

Enter your tax liabilities in the month that corresponds to the dates you paid wages to your employees, not the date payroll liabilities had been accrued or deposits have been made. Enter the end result in the “Total legal responsibility for quarter” box. Enter the total wages, sick pay, and taxable fringe benefits subject to social security taxes you paid to your employees in the course of the quarter. For this objective, sick pay consists of payments made by an insurance company to your workers for which you received timely discover from the insurance coverage company. See the instructions for line eight, later, for an adjustment that you can be have to make on Type 941 for sick pay.

With the right payroll instruments, finishing IRS Form 941 turns into less of a problem and extra of a routine part of running a compliant enterprise. If the due date falls on a weekend or vacation, the form is due on the next enterprise day. Utilizing a payroll useful resource guide, such as IRS Publication 15 or 15-A, can help ensure that you perceive your duties and remain compliant.

Consistent with the entries on line sixteen or Schedule B (Form 941), the payroll tax credit ought to be taken under consideration in making deposits of employment tax. The payroll tax credit will not be taken as a credit score against earnings tax withholding, the employee share of social security tax, or the worker share of Medicare tax. Also, the remaining payroll tax credit score may not be carried back and taken as a credit towards https://www.intuit-payroll.org/ wages paid from preceding quarters. Typically, as an employer, you are accountable to make sure that tax returns are filed and deposits and payments are made, even if you contract with a third get together to perform these acts. You stay responsible if the third celebration fails to carry out any required motion.

The form is due the following business day if the deadline falls on a weekend or vacation. If there are corrections or adjustments to be made for prior quarters, remember to embrace them in Half three. Ignoring these changes could cause inaccuracies in your records. Whereas in a roundabout way linked to credit score scores, timely filings contribute to your total monetary health, stability, and credibility. Utilizing an automated payroll system can scale back errors and streamline compliance with these requirements. Name now or fill in the form below to get assist with your tax and IRS points right now.

This quarterly form ensures the IRS receives correct payroll tax payments and that your records match at year-end. Failure to well timed file a Form 941 and pay any tax due may end in a penalty of 5% of the tax due with that return for every month or part of a month the return is late. A separate penalty applies for making tax funds late or paying lower than you owe. The penalties are 2% to 15% of your underpayment, relying on what quantity of days you’re late paying the right amount.

- Not submitting IRS Form 941 by the due date or reporting much less tax legal responsibility than what you actually owe can result in stiff IRS penalties.

- The type is used to report wages paid and suggestions workers reported to employers, together with federal revenue tax, Social Security tax, and Medicare tax withheld.

- The payroll tax credit score election have to be made on or before the due date of the initially filed income tax return (including extensions).

- Underneath an installment settlement, you’ll find a way to pay what you owe in monthly installments.

Also embrace sick pay paid by a 3rd get together that is not your agent (for instance, an insurance coverage company) if you got well timed discover of the funds and the third party transferred legal responsibility for the employer’s taxes to you. If federal income, social safety, and Medicare taxes that should be withheld (that is, belief fund taxes) aren’t withheld or aren’t deposited or paid to the United States Treasury, the trust fund recovery penalty could apply. The belief fund restoration penalty will not apply to any quantity of belief fund taxes an employer holds back in anticipation of any credits they’re entitled to. Your deposit schedule is not decided by how usually you pay your staff. Your deposit schedule is decided by the total tax liability you reported on Kind 941 during the earlier 4-quarter lookback period (July 1 of the second previous calendar 12 months via June 30 of the previous calendar year). If you filed Type 944 in either 2023 or 2024, your lookback period is the 2023 calendar yr.

Monthly depositors should deposit employment taxes by the fifteenth of the following month. Your employee should report cash tips to you by the 10th day of the month after the month the ideas are acquired. Cash suggestions embody ideas paid by cash, examine, debit card, and credit card. Each instantly and indirectly tipped workers should report tricks to you. No report is required for months when suggestions are lower than $20.

Does Form 941 Need To Be Filed Electronically?

If you need to permit an employee, a paid tax preparer, or one other individual to discuss your Kind 941 with the IRS, verify the “Yes” box in Part 4. Enter the name, phone number, and five-digit private identification quantity (PIN) of the specific individual to talk with—not the name of the agency that ready your tax return. Additionally, if you full Form 941, make certain to check the field on the highest of the shape that corresponds to the quarter reported. If you hire staff seasonally—such as for summer time or winter only—check the field on line 18. Checking the field tells the IRS to not expect four Varieties 941 from you throughout the year because you have not paid wages often. If your web adjustment during a month is unfavorable and it exceeds your whole tax liability for the month, do not enter a adverse amount for the month.

The deposits are due by the last day of the month following the tip of each quarter. The annual Kind 940 is then filed by January 31 of the next year. If you need assistance with ongoing tax preparation and submitting, consider working with a tax skilled who focuses on employment taxes to keep up compliance. Submitting deadlines for Form 941 are strict, falling on the last day of the month following a quarter’s finish. Failure to file or underreporting can end result in important penalties.

Not all forms of businesses have to file Type 941, including some seasonal companies, corporations that employ farmworkers, and people employing family employees, such as maids (but they may must file Form 1040 instead). The deadlines for filing Form 941 are strict, and so they fall on the final day of the month following the end of 1 / 4 (April 30, July 31, Oct. 31, and Jan. 31). Manay CPA is a reputable, full-service CPA firm based in Atlanta, Georgia.